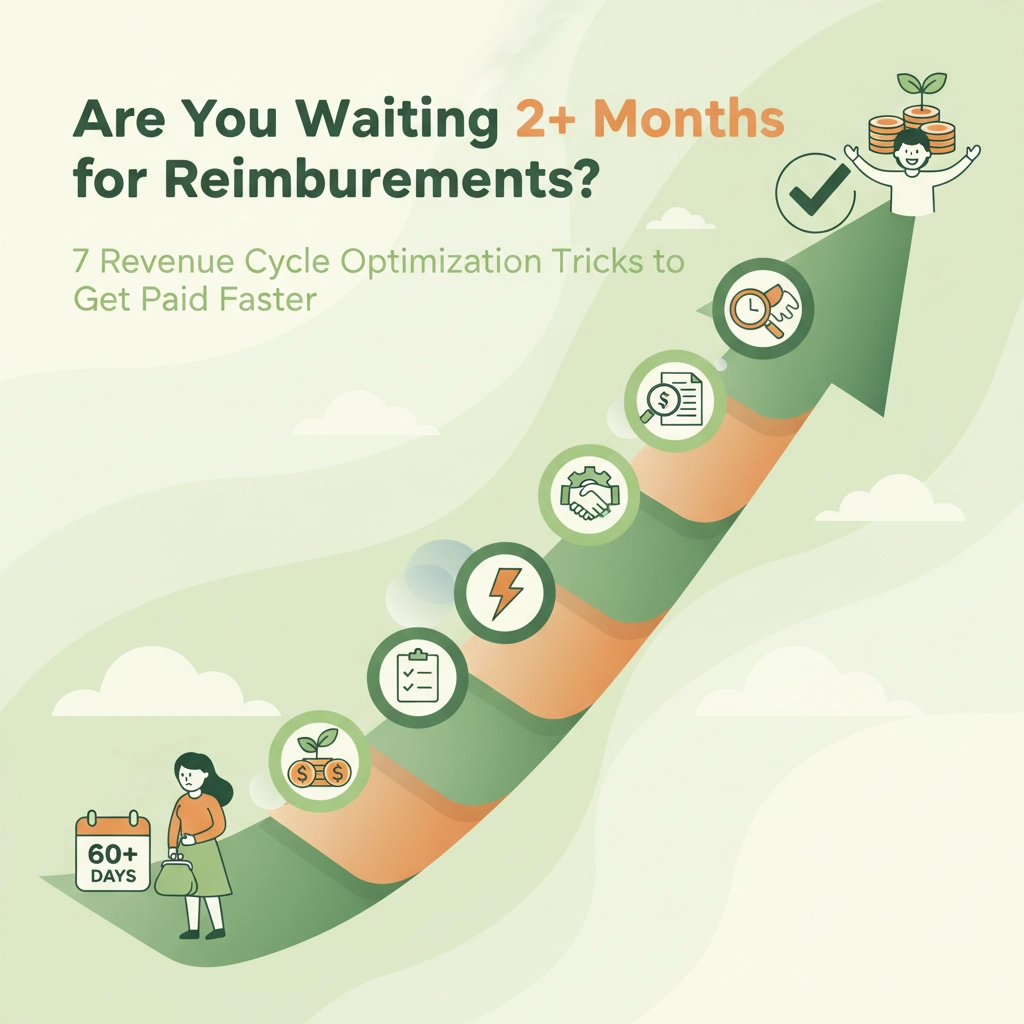

Two months. That’s how long many healthcare providers are waiting for reimbursements that should arrive in 30 days or less. If this sounds familiar, you’re not alone: and more importantly, you’re not stuck with this reality.

Delayed reimbursements don’t just hurt your cash flow; they impact your ability to serve patients, invest in staff, and grow your practice. The good news? Most payment delays stem from fixable issues in your revenue cycle process.

We’ve worked with hundreds of healthcare organizations to identify the most common bottlenecks: and the proven strategies that get payments flowing faster. Here are seven optimization tricks that can dramatically reduce your reimbursement timeline.

1. Perfect Your Patient Information Collection at Intake

Your revenue cycle success starts the moment a patient walks through your door. Incomplete or incorrect patient information is one of the top causes of claim delays, rejections, and denials.

Here’s what makes the difference:

Implement real-time eligibility verification during registration. Don’t wait until after services are rendered to discover coverage issues.

Use electronic intake forms that validate information as patients enter it. This catches errors like incorrect insurance member IDs before they become claim problems.

Train your front desk staff to ask the right questions and verify insurance cards carefully. A few extra minutes at intake can save weeks in the back-end revenue cycle.

Create standardized intake protocols so every patient receives consistent, thorough registration regardless of who’s working the front desk.

When patient information is accurate from day one, you eliminate the most common reason for claim delays and resubmissions.

2. Automate Your Eligibility and Benefits Verification

Manual eligibility checks create unnecessary bottlenecks that slow down your entire revenue cycle. Every minute spent on phone calls with insurance companies is time that could be spent on patient care or other revenue-generating activities.

Invest in automated eligibility verification tools that check patient benefits in real-time. These systems can verify coverage, copay amounts, deductible status, and prior authorization requirements instantly.

Set up automated alerts for coverage changes or lapses. When a patient’s insurance status changes between appointments, you’ll know immediately rather than discovering it after services are rendered.

Integrate verification with your scheduling system so eligibility is automatically checked when appointments are booked. This proactive approach prevents surprise coverage issues and allows you to collect payments upfront when appropriate.

Automation doesn’t just speed up verification: it improves accuracy and frees your staff to focus on higher-value activities.

3. Master the Art of Clean Claims Submission

Your First-Pass Resolution Rate (FPRR): the percentage of claims paid on first submission: is one of the most critical metrics for fast reimbursements. Every claim that gets rejected or denied means additional work, delays, and potential revenue loss.

Implement claim scrubbing technology that catches errors before submission. These systems check for common issues like missing modifiers, incorrect coding, or incomplete documentation.

Establish coding quality assurance processes with regular audits and continuing education for your coding staff. Accurate coding is essential for appropriate reimbursement and avoiding denials.

Use predictive analytics to identify claims at high risk for denial. Machine learning tools can flag potential problems based on historical data patterns, allowing you to address issues proactively.

Create standardized workflows for claim preparation and review. When everyone follows the same process, you reduce the chance of errors slipping through.

A strong FPRR means faster payments and less administrative burden on your team.

4. Leverage Technology and Automation Across Your Revenue Cycle

Manual processes are error-prone and time-consuming. Strategic automation can dramatically speed up your revenue cycle while improving accuracy.

Automate charge capture to ensure all services are captured and billed appropriately. Electronic systems reduce the risk of missed charges or coding errors.

Implement automated payment posting that matches payments to claims and posts them to patient accounts without manual intervention.

Use robotic process automation (RPA) for repetitive tasks like claim status checks, prior authorization requests, and patient payment reminders.

Integrate your systems so information flows seamlessly from your EHR to your practice management system to your billing software. Eliminating manual data entry reduces errors and speeds up processes.

Consider cloud-based revenue cycle management platforms that offer real-time visibility into your entire revenue cycle with automated workflows and built-in best practices.

Technology investments pay for themselves through improved efficiency and faster collections.

5. Implement Data-Driven Performance Monitoring

You can’t improve what you don’t measure. Real-time analytics provide the insights you need to identify bottlenecks and optimize your revenue cycle continuously.

Track key performance indicators (KPIs) including days in accounts receivable, denial rates, collection rates, and time from service to payment.

Set up automated dashboards that provide real-time visibility into your revenue cycle performance. When metrics start trending in the wrong direction, you can address issues immediately.

Benchmark against industry standards to understand how your performance compares to similar organizations. This helps identify areas with the greatest improvement potential.

Use predictive analytics to forecast cash flow and identify potential collection problems before they impact your bottom line.

Conduct regular performance reviews with your revenue cycle team to discuss metrics, identify improvement opportunities, and celebrate successes.

Data-driven decision making transforms your revenue cycle from reactive to proactive.

6. Optimize Your Denial Management Process

Even with the best prevention strategies, some denials are inevitable. How quickly and effectively you handle them determines their impact on your cash flow.

Implement systematic denial management workflows that prioritize denials by dollar amount and likelihood of successful appeal.

Automate denial categorization to identify patterns and root causes. When you understand why denials are happening, you can implement targeted prevention strategies.

Set up automated claim status inquiries to identify potential issues before they become formal denials.

Create standardized appeal processes with templates, documentation requirements, and tracking mechanisms.

Establish clear timelines for denial resolution and assign accountability to specific team members.

Keep payer rules and requirements up to date to avoid denials due to changing guidelines or policies.

Effective denial management recovers revenue that might otherwise be lost and provides valuable insights for preventing future denials.

7. Consider Strategic Outsourcing for Specialized Functions

Sometimes the fastest path to improved performance is partnering with specialists who can provide expertise and efficiency that’s difficult to achieve in-house.

Evaluate your current staffing challenges and identify areas where outsourcing could provide immediate improvement. Common candidates include coding, denial management, and patient collections.

Partner with experienced revenue cycle management companies that have proven track records and can provide detailed performance metrics.

Consider hybrid models where you outsource specific functions while maintaining control of patient-facing activities and strategic decision-making.

Look for partners who use advanced technology and can provide insights and best practices that benefit your entire organization.

Ensure clear communication and reporting so you maintain visibility into outsourced functions and can measure their impact on your overall performance.

Strategic outsourcing allows you to access specialized expertise without the time and cost of building internal capabilities.

Moving from Waiting to Winning

Implementing these seven optimization strategies can dramatically reduce your reimbursement timeline and improve your cash flow. The key is to approach optimization systematically, starting with the areas that will have the biggest impact on your specific situation.

Remember, revenue cycle optimization isn’t a one-time project: it’s an ongoing process of continuous improvement. As payer requirements change and your organization grows, your processes need to evolve as well.

The investment you make in optimizing your revenue cycle pays dividends not just in faster payments, but in reduced administrative burden, improved staff satisfaction, and better patient experiences.

Ready to stop waiting and start winning? Contact our team for a comprehensive revenue cycle assessment. We’ll identify your biggest opportunities for improvement and create a customized action plan to get your reimbursements flowing faster. Your cash flow: and your team will thank you.